Baker Tilly advises VR Equitypartner on merger of electronics specialists Assdev and Solectrix

- 11/12/2024

- Reading time 2 Minutes

Baker Tilly was responsible for the financial due diligence and company valuation for VR Equitypartner, a DZ BANK subsidiary. In the course of the add-on acquisition, Assdev Group merges with Solectrix Group, an existing portfolio company of VR Equitypartner.

Frankfurt am Main, 12. November 2024 – The international consulting firm Baker Tilly has advised VR Equitypartner, one of the leading equity financiers for the SME sector, on the merger of the two embedded electronics specialists Assdev and Solectrix. Nils Klamar (Partner), Björn Prawetz (Director) and Max Bracht (Manager, all three Frankfurt am Main) were responsible for the financial due diligence and company valuation for the DZ BANK subsidiary.

“Congratulations to VR Equitypartner on this far-sighted strategic investment,” says Nils Klamar. “We are very happy about the trust placed in us in the areas of financial due diligence and valuation. This engagement once again shows that we are a strong partner for the financial sector in the area of deal advisory.”

VR Equitypartner has held a minority stake in Solectrix since 2021 and supports the company in its growth strategy and in consolidating its market position as an innovation leader.

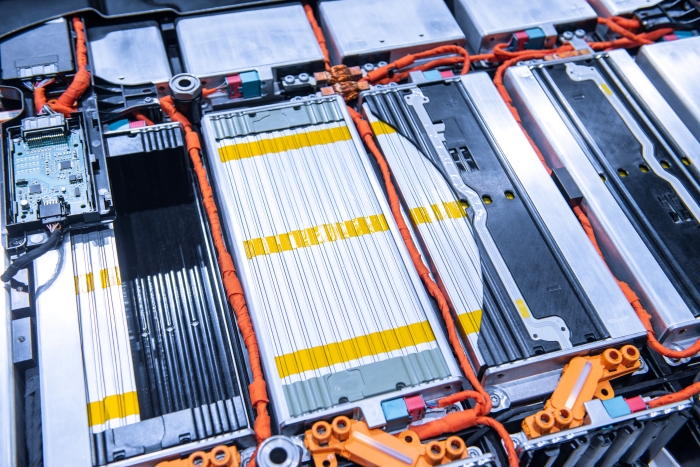

Assdev and Solectrix have a long-standing business relationship. In future, the two companies will act as a leading full-service partner for highly developed electronics solutions. The new group of companies will employ around 250 people and achieve an annual turnover of more than 40 million euros. The companies will continue to operate on the market under the names solectrix, solectrix Systems, ASSDEV und AST-X. The transaction is subject to regulatory approvals and is expected to be completed this year.

About VR Equitypartner

VR Equitypartner is one of the leading equity financiers in Germany, Austria and Switzerland. With decades of experience, the company supports medium-sized family businesses in finding strategic solutions to complex financing issues. Investment opportunities include growth financing and expansion financing, company successions or changes in shareholders. VR Equitypartner offers majority and minority shareholdings as well as mezzanine financing. As a subsidiary of DZ BANK, the central institution of the co-operative banks in Germany, VR Equitypartner consistently prioritizes the sustainability of corporate development over short-term exit thinking. The VR Equitypartner portfolio currently comprises around 40 commitments with an investment volume of EUR 400 million.

Further information is available at www.vrep.de